Self-Worth Is Not Net-Worth

But, is it?

I’d like to preface this by mentioning that when I thought up the idea of an article on self-worth vs net worth, I assumed I was one of our generation’s greatest minds.

Turns out every writer and their dog has written about this, and for those of you that go the extra mile and read some other articles on the matter, I’m sure you’ll find a similarity or three.

I’m paraphrasing here, but I think it was Matthew Mcconaughey's Mother who once said — If you understand it, and you like it, then it’s yours.

So… sue me.

I’ve predominantly focused on the negative side of the correlation between self-worth and net-worth, however, there are both sides to this story.

Almost all of my portfolio is allocated to risk-on assets, and if you have seen the state of these in the last few months, you’ll understand why I’m exploring the topic.

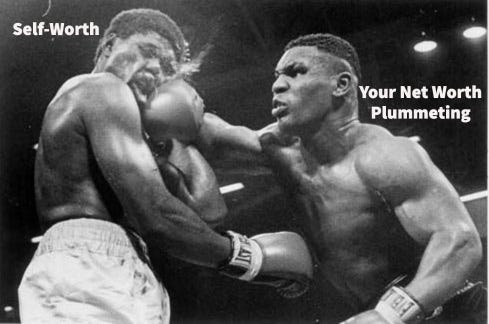

I’d like to think about this subject being a little like the famous quote from Big Mikey Tyson.

“Everyone has a plan until they get punched in the face”

I could perhaps tell you that self-worth is not net-worth, but when you just broke your allocation % rules to keep up with 14-year-olds 10xing their life savings on meme coins, and your portfolio just nuked -75%, I can tell you first-hand that your self-worth most certainly feels a little f***ing correlated to your net-worth.

A lot of the aforementioned articles centre around why you can’t measure your self-worth by net-worth, but — speaking for myself here — in a digital age where you can immediately access your bank balance, buy anything from anywhere in just a few clicks, and watch your financial investments plummet 24/7 365 days a year, its a little easier said than done.

The Joneses still need keeping up with, and now they’re everywhere.

As someone who grew up directly correlating stress with a lack of coinage, whether valid or not, I began a frugal journey of accumulation to future-proof my finances as early in my life as possible.

It was a simple equation: Mo’ money = Less Problemo

Subsequently, the lines between self-worth and net worth have been blurred ever since.

As it turns out, the equation isn’t so simple, and linking the two distinctions has made for some pretty unhealthy comparisons.

So let’s break it down.

I understand most of you have a pretty clear idea as to the definitions of each, but for those of you like myself that need a healthy reminder:

Self-worth: One’s own value, or worth as a person e.g. self-respect.

Net worth: Net assets minus liabilities.

On a higher level, the difference resides between measuring your worth in qualitative (self) vs quantitative (cash monies) methods.

Your own worth in a subjective vs objective light.

Now that we have some clear guidelines separating the pair, why is it so easy to blend them up into a shitstorm martini?

From my experience — and judging by the number of articles on this subject, I’m not alone — we’re subconsciously geared towards quantitative measurements of worth.

See - this is my quant.

We can break this down further into two cognitive biases.

1. Availability

Danny Kahneman explores the concept of the availability heuristic in ‘Thinking Fast & Slow’. As a very brief crash course on the subject, the author’s work has directly contradicted the ideas of traditional economists, wherein he argues that humans are not in fact, rational.

As Kahneman divides the brain into system 1 — fast, irrational, knee-jerk reactions — and system 2 — slow, rational, complex computations — we can draw parallels to the idea in discussion.

Our system 2 is lazy, and engaging it requires an effort that is easily depleted throughout the day. So when you see your buddy from high school driving that nice new car, a colleague’s raise has him earning more than you, or spend your whole day watching the charts — I’d be quite certain that it takes more gas than we have in the tank at times to reason why our self-worth shouldn’t be affected by these factors.

2. Survivorship

The classic ‘dead men tell no tales’ aptly applies here.

Survivorship bias explores the notion that we only see the successes of others, not all of the failures in the process or the ones that got lost along the way.

No one makes a LinkedIn/Insta post about how amazingly mediocre their new ‘x’ is.

With the mass of info that is available to us at the touch of our fingertips at any point in time, it’s relatively easy to scroll your way into oblivion, looking — but not doing anything about it — at everyone else’s financial success.

At those very moments, I could point out that your irrational brain isn’t thinking about how amazing a person you are deep down inside, or how your self-care routine really set you up for a solid day of being a decent person tomorrow.

So, it goes without saying that having a direct correlation between your two measurements of worth isn’t entirely healthy, but how do we learn to separate these?

Honestly, I’m still trying to figure this out for myself, so the best thing I can do is flick you to this article, it’s got some great points that I couldn’t articulate better myself.

So, what’s the verdict?

Look I’m sure there’s an inflection point that up until a certain level of income/net worth, you’re probably not too worried about the difference between the two, and more concerned with bringing home the bacon.

But for those of us who are lucky enough to ask ourselves questions like these:

No.

Self-worth is not net worth, you’re more than what’s in your back pocket.

Or am I just telling myself this because my net-worth has seen better days?

- Archer

p.s. FYI I have no idea how long it takes most people to write. Assuming I am much slower than most, this took four and a half hours to research, flesh out, and edit, which I’d ideally like to sharpen up quite a bit.

I keep a log of ideas for articles I’d like to write about, so aside from the initial idea, this period encompasses everything else - Mostly just blankly staring at the screen.

p.p.s. If you say net-worth and self-worth enough times, you start to sound ridiculous.

Epic ideas, felt like I was reading the thoughts of a journalist for the New York Times